Residents of New Glasgow, N.S., can now apply for free home assessments and upgrades to protect against overland flooding, through a new project by Clean Foundation. The Dartmouth-based environmental charity is partnering with Nova Scotia's Department of Environment and Climate Change, the Town of New Glasgow and the Halifax Regional Municipality to kick start the resilient home retrofit pilot project. In May, the province spent $400,000 on this initiative.

Family waiting months for water after neighbour's oil spill contaminates well

A family of five in Howie Centre, N.S., has gone for months without clean water in their Cape Breton home after their well was contaminated by heating oil. They say officials from Nova Scotia's Environment Department confirmed a spill occurred on a neighbour's property earlier this year, but so far, little is being done about it and there are fears the oil has now spread to the nearby Sydney River.

More than 100 Edmundston households report damage following torrential rains

Julie Gagnon and Hugo Lajoie leaned on the barrier that separates them from their home in Edmundston, N.B. In front of them, a massive hole created by a landslide threatened to swallow up their shed and their house. Thursday's torrential rains forced them from almost all their belongings in the area of Verret Street. They have also been told their insurance does not cover this type of disaster. "I contacted our insurance company for a claim and they rejected it because these damages were not in my contract," Gagnon told Radio-Canada on Saturday while fighting back tears. "I called two or three times and there was nothing to be done. We pay for insurance and we have no help."

Property owner learns a hard lesson on insurance against water damage

In early December, while the property was unoccupied, Morgan’s real estate agent phoned him to advise that the house had been damaged as a result of a burst water connection to a second-floor toilet. Co-operators investigated the claim and denied coverage. The company’s position was that there was no insurance coverage for water damage after the property was vacant for more than five days, and there was no insurance at all for any loss if the dwelling was vacant for more than 30 consecutive days.

Why mitigation matters amid US$100 billion plus cat losses

Last year’s catastrophe losses pose a stark reminder of the need to build resilience and educate people about risk mitigation and insurance, according to Aon executives. Global insured losses from natural disasters and climate events topped US$100 billion (CAN$134 billion) for third year in a row, according to a new report by global broking giant Aon. The 2023 weather, climate and catastrophe insight report revealed that natural disasters caused US$313 billion in economic losses globally in 2022, 4% above the 21st-century average.

Some Saskatoon homeowners clean up after torrential rain; others spared by new dry pond

Pius Gartner says he had to take off his shoes and pants so he could enter his home without getting them soaked last Monday. His corner-lot property became waterfront temporarily when parts of Saskatoon were pummelled by torrential rain. "Every time it rains heavy this corner floods, but this time it was 14 inches above my back door, so she was tough to hold back the water," he said, noting the water poured in through his basement windows and clothes-dryer vent.

Hundreds of residents in Merritt, B.C., still out of their homes 3½ months after devastating floods

When Donna Rae moved to Merritt, B.C., from Vancouver, she bought a small retirement home where she figured she'd spend the rest of her life. But late last year, that home became filled with mud, water and debris from the Coldwater River — one of many destroyed during devastating floods in November. Now Rae, 70, says she wishes she'd never moved to the city in B.C.'s southern Interior. "Now I'm wishing I'd stayed at the coast, so I don't have to deal with this," she said.

Insurance isn't enough: Governments need to do better on natural disaster resilience

The massive floods in British Columbia in November 2021 demonstrated the devastation that natural disasters can cause in Canada. Prior to 2010, it was rare for annual insured losses from natural disasters in Canada to exceed $1 billion, but now insured losses of $3 billion are not uncommon. Canada is expected to become wetter, stormier, warmer and to experience more severe connective storms and wildfires. The Insurance Institute of Canada forecasts that annual insured losses could increase to $5 billion within the next 10 years.

This P.E.I. man wants shore protection but the province won't let him have it

A riverfront property owner says he's been left with thousands of dollars in cement blocks with nowhere to put them. That's after P.E.I.'s Environment Department denied his proposal to have shoreline protection installed, citing concerns it would have a "detrimental effect" on a salt marsh at the corner of his property. "All I'm doing is trying to protect my property," said Mark Keizer, who lives with his wife along the Hillsborough River in Mermaid, with a view toward Charlottetown Harbour.

Heatwaves and drought conditions devastating for southern Alberta farmers

Southern Alberta farmers say consistently hot weather combined with little rain in the last few months has been devastating for their crops this year. In July 2020, Kim Owen took a photo of his father Richard Owen standing in one of their fields in Wrentham, Alta., with a crop growing above his waist. On Saturday, Kim snapped another photo of his father in the exact same spot but this time the earth was yellow and dried crops barely grazed Richard's ankles.

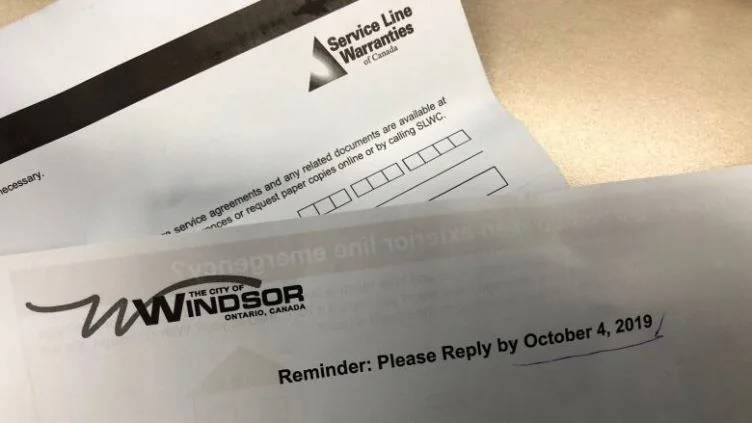

Insurance Bureau of Canada says private company's sewer, water line warranty might not be worth it

According to the Insurance Bureau of Canada's director of consumer and industry relations for Ontario, it might not be worth it to sign up for a new, optional sewer and water line warranty program introduced last July by the City of Windsor. "Rather than going out and purchasing another policy, we recommend that consumers, homeowners, contact their own insurance company and see if, A, this coverage is part of their current policy, or, B, can they add it on as an optional coverage," said Pete Karageorgos, with the Insurance Bureau of Canada.

'It's a problem for society': Climate change is making some homes uninsurable

As an insurer, Intact obviously has its own data and maps. Based on that, the company assumes as many as five per cent of those newly at-risk properties will be simply uninsurable. Brindamour warns that "if you're in a zone that gets flooded repeatedly, or where the odds of being flooded has increased meaningfully, it'll be hard to find insurance from private capital."